Seven Tips to Maximize Your HSA

- Use over-the-counter (OTC) drugs if at all feasible. Some medications that were once only available by prescription can now be found on store shelves. You must have a doctor’s prescription to use your health savings account for OTC drugs, but your costs can drop as much as 80 percent using OTCs.

- Only visit the emergency room in an actual emergency situation. Remember that your doctor’s office and urgent care are other appropriate options for conditions that are not life-threatening – and they are a lot more cost-effective.

- Beware of possible medical errors. Over 1 million medical errors occur in the U.S. every year, costing over $2 billion. In order to avoid error-prone facilities, make sure to select places that use “computerized order entry” of medications, which reduces serious prescribing errors by more than 50 percent. Also, research the best medical facilities in your area. If you go into a hospital for a high-risk procedure (such as open-heart surgery), choose one with plenty of experience and consistently good results.

- Stay in network. Doctors, hospitals and other health care providers in the network have a contract to provide reduced rates to our members. This helps you save.

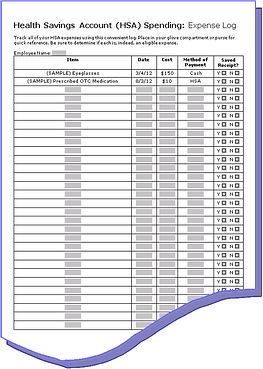

- Know what expenses are eligible. You may spend the HSA money tax-free on out-of-pocket medical expenses, such as your deductible, co-payments for medical care, prescription drugs, or bills not covered by insurance such as vision and dental care. The IRS determines the types of medical expenses you can use tax-free with HSA funds. They are listed in IRS Publication 502.

If you use HSA funds for non-medical expenses, you are required to pay taxes on the withdrawal, plus a 20% penalty before age 65.

- Know before you go. Compare what doctors and hospitals will charge you for some common services before you make an appointment.

- Keep your receipts. Lastly, you must keep receipts for everything you purchase using your HSA. If your HSA is ever audited you will need a record of your expenses. The easiest way to do this? Take a picture or scan your receipts and keep them electronically, or use the attached template.

Click on the image to download your HSA Log